Dear Shareholder:Shareholder of Vericel Corporation:

You are cordially invited to attend ourthe Virtual Annual Meeting of Shareholders of Vericel Corporation (the “Annual Meeting”), a Michigan corporation. The Annual Meeting will be held on Wednesday, May 2, 20181, 2024, at 9:00 a.m., local time, Eastern Time, via a live audio webcast at Vericel Corporation's headquarters locatedwww.virtualshareholdermeeting.com/VCEL2024. A list of shareholders entitled to vote at 64 Sidney St., Cambridge, MA 02139.

At this Annual Meeting, the agenda includes (1) the election of seven (7) directors, (2) the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018, (3) an advisory vote on the frequency of future advisory votes to approve the compensation of our named executive officers, and (4) the approval, on an advisory basis, of the compensation of our named executive officers. The Board of Directors unanimously recommends that you voteFOR the election of each director nominee,FOR the ratification of the appointment of PricewaterhouseCoopers LLP, for every1 YEAR as the frequency of holding future advisory votes on the compensation of our named executive officers andFOR the approval, on an advisory basis, of the compensation of our named executive officers.

All shareholders are cordially invited to attend the Annual Meeting will be available for inspection by any shareholder at our offices in person. Enclosed areCambridge, Massachusetts during ordinary business hours for a Noticeperiod of Annual Meeting of Shareholders and Proxy Statement describing10 days prior to the formal businessmeeting. This list will also be available for shareholders to be conductedview online at the meeting. Under Securities and Exchange Commission rules, we are providing access to the proxy materials for the Annual Meeting to our shareholders via the Internet. Accordingly, you can access the proxy materials and vote at www.proxyvote.com. Instructions for accessing the proxy materials and voting are described below and in the Notice of Annual Meeting of Shareholders that you received in the mail. Please give the proxy materials your careful attention.

Whether or not you plan to attend the meeting, please carefully review the enclosed Proxy Statement and then cast your vote, regardlesstime of the number of shares you hold. If you are a shareholder of record, you may vote via the Internet, by telephone, or, if you request to receive a printed set of the proxy materials, by completing, signing, dating and mailing the accompanying proxy card in the prepaid envelope. In order to vote via the Internet or by telephone, you must have the shareholder identification number which is provided in your Notice. If you attend the Annual Meeting, you may vote in person even if you have previously voted via the Internet, by telephone or by returning your proxy card. Please review the instructions for each voting option described in this Proxy Statement. Your prompt cooperation will be greatly appreciated.meeting.

The Board of Directors and management team look forward to seeing you at the Annual Meeting.

Voting Items

| Proposal | Board Voting

Recommendation | For Further

Details |

| 1 | | Sincerely, |

|

|

|

|

|

DOMINICK C. COLANGELO

President and Chief Executive Officer |

Table of Contents

TABLE OF CONTENTS

| | | | |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

| | | | |

PROXY STATEMENT FOR ANNUAL MEETING OF SHAREHOLDERS

| | |

1 | |

GENERAL INFORMATION ABOUT THE MEETING, SOLICITATION AND VOTING

| | |

1 | |

What am I voting on?

| | |

1 | |

Who is entitled to vote?

| | |

1 | |

What constitutes a quorum?

| | |

1 | |

How many votes are required to approve each proposal?

| | |

2 | |

How are votes counted and who are the proxies?

| | |

2 | |

What is a broker non-vote?

| | |

3 | |

How does the Board of Directors recommend that I vote?

| | |

3 | |

How do I vote my shares without attending the meeting?

| | |

3 | |

How do I vote my shares in person at the meeting?

| | |

4 | |

What does it mean if I receive more than one proxy card?

| | |

4 | |

May I change my vote?

| | |

4 | |

What are the costs associated with the solicitation of proxies?

| | |

4 | |

PROPOSAL 1

| | |

5 | |

Director Nominees for Election at the 2018 Annual Meeting of Shareholders

| | |

5 | |

Vote Required and Board of Directors' Recommendation

| | |

8 | |

Board Meetings and Committees

| | |

8 | |

Director Nominations

| | |

9 | |

Board of Directors Leadership Structure

| | |

11 | |

Shareholder Communications with Directors

| | |

12 | |

Director Attendance at Annual Meetings

| | |

12 | |

Code of Ethics

| | |

12 | |

Board of Directors Member Independence

| | |

12 | |

Risk Oversight

| | |

12 | |

PROPOSAL 2

| | |

13 | |

Overview

| | |

13 | |

Vote Required and Board of Directors' Recommendation

| | |

14 | |

PROPOSAL 3

| | |

15 | |

Overview

| | |

15 | |

Vote Required and Board of Directors' Recommendation

| | |

15 | |

| | | | |

i

Table of Contents

| | | | |

PROPOSAL 4

| | | 16 | |

Overview

| | |

16 | |

Vote Required and Board of Directors' Recommendation

| | |

16 | |

STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

| | |

17 | |

EXECUTIVE COMPENSATION AND RELATED INFORMATION

| | |

18 | |

Compensation Discussion and Analysis

| | |

18 | |

Compensation Committee Report

| | |

24 | |

Summary Compensation Table

| | |

24 | |

Grants of Plan-Based Awards

| | |

25 | |

Outstanding Equity Awards at Fiscal Year End

| | |

26 | |

Option Exercises and Stock Vested

| | |

27 | |

Pension Benefits

| | |

27 | |

Nonqualified Deferred Compensation

| | |

27 | |

Employment Contracts, including Termination of Employment and Change of Control Arrangements

| | |

27 | |

Acceleration of Vesting Under Stock Option Plans

| | |

30 | |

CEO Pay Ratio

| | |

31 | |

Equity Compensation Plan Information

| | |

32 | |

Compensation of Directors

| | |

32 | |

Certain Relationships and Related Party Transactions

| | |

34 | |

Section 16(a) Beneficial Ownership Reporting Compliance

| | |

34 | |

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

| | |

34 | |

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

| | |

35 | |

AUDIT COMMITTEE

| | |

35 | |

SHAREHOLDER PROPOSALS TO BE PRESENTED AT NEXT ANNUAL MEETING

| | |

35 | |

WHERE YOU CAN FIND MORE INFORMATION

| | |

36 | |

TRANSACTION OF OTHER BUSINESS

| | |

37 | |

ii

Table of Contents

VERICEL CORPORATION

64 Sidney St.

Cambridge, MA 02139

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held May 2, 2018

| | |

TIME | | 9:00 a.m., local time, on Wednesday, May 2, 2018 |

PLACE |

|

Vericel Corporation, 64 Sidney St., Cambridge, MA, 02139 |

ITEMS OF BUSINESS |

|

1. To elect seven (7)eight (8) directors, each to each serve a term of one year expiring at the 2019 Annual Meeting of Shareholders;2025 annual meeting |  FOR each FOR each

director nominee | Page 19 |

2 |

To approve, on an advisory basis, the compensation of our named executive officers |

2.  FOR FOR | Page 42 |

| 3 | To cast an advisory vote on the frequency of future non-binding, advisory votes to approve the compensation of our named executive officers |  Every 1 YEAR Every 1 YEAR | Page 63 |

| 4 | To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018;2024 |  FOR FOR | Page 64 |

Shareholders will also consider such other business as may properly come before the Annual Meeting and any adjournment thereof.

By Order of the Board of Directors,

Sean Flynn

Senior Vice President, General Counsel and Secretary

Cambridge, Massachusetts

March 21, 2024

| BACKGROUND |

|

|

3. To cast an advisory vote on the frequency of future advisory votes to approve the compensation of our named executive officers;Date and Time May 1, 2024, at

9:00 a.m. Eastern Time |

|

|

4. To approve, on an advisory basis, the compensation of our named executive officers; and |

|

|

5. To consider such other business as may properly come before the Annual Meeting of Shareholders and any adjournment thereof.Location Via a live audio webcast at www.virtualshareholder meeting.com/VCEL2024 |

RECORD DATE |

|

|

Who Can Vote You may vote at the Annual Meeting of Shareholders if you were a shareholder of record at the close of business on March 9, 2018. 8, 2024 |

| |

VOTING BY PROXYMETHODS |

|

|

If you cannot attend the Annual Meeting of Shareholders, you may vote your shares via the  | Internet by telephone by followingor Telephone Follow the instructions on your proxy card and onat www.proxyvote.com. If you have requested a proxy card by mail, you may vote by signing, voting |

| |

| Mail Vote, sign and returningreturn the proxy card to Broadridge Financial Solutions, 51 Mercedes Way, Edgewood, New York 11717. For specific instructions on how to vote your shares, please review the instructions for each of these voting options as detailed in your Notice and in this Proxy Statement. If you attend the Annual Meeting, you may vote in person even if you have previously voted via the Internet, by telephone or by returning your proxy card. |

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE PROMPTLY COMPLETE YOUR PROXY AS INDICATED ABOVE IN ORDER TO ENSURE REPRESENTATION OF YOUR SHARES. PLEASE REVIEW THE INSTRUCTIONS FOR EACH11717

Table of Contents

OF YOUR VOTING OPTIONS DESCRIBED IN THIS PROXY STATEMENT AND THE NOTICE YOU RECEIVED IN THE MAIL.

| | |

| | |

By order of | Online at the Board of Directors, |

|

|

|

|

|

JACQUELYN FAHEY SANDELL

Corporate Secretary

Cambridge, Massachusetts

March 22, 2018Annual Meetingwww.virtualshareholdermeeting. com/VCEL2024 |

If you attend the Annual Meeting, you may vote during the meeting even if you have previously voted via the Internet, by telephone, or by returning your proxy card.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE VERICEL 20182024 VIRTUAL ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 2, 2018: 1, 2024

The Notice of Virtual Annual Meeting of Shareholders, proxy statement,Proxy Statement, proxy card and our Annual Report on Form 10-K for the fiscal year ended December 31, 20172023, are available at www.vcel.com by following the link for "Investor“Investor Relations."” To obtain directions to our offices in ordermore information concerning how to attend the Annual Meeting in person,via the live audio webcast, please contact Investor RelationsVericel Corporation at (734) 418-4411.

(617) 588-5555.

TableWhether or not you plan to attend the Annual Meeting, please promptly complete your proxy as indicated above in order to ensure representation of Contentsyour shares. For specific instructions on how to vote your shares, please review the instructions for each of these voting options as detailed in your Notice and in this Proxy Statement.

| |

| 4 |  |

VERICEL CORPORATION

64 Sidney St.

Cambridge, MA 02139

PROXY STATEMENT FOR ANNUAL MEETING OF SHAREHOLDERS

This Proxy Statement is being furnished in connection with the solicitation of proxies by the Board of Directors (the "Board of Directors") of Vericel Corporation (the “Board of Directors” or the “Board”), a Michigan corporation, for use at the Annual Meeting of Shareholders to be held on Wednesday, May 2, 20181, 2024, at 9:00 a.m., local time, Eastern Time, via a live audio webcast at our headquarters located at 64 Sidney St., Cambridge, MA 02139,www.virtualshareholdermeeting.com/VCEL2024 or at any adjournments or postponements thereof (the "Annual Meeting").thereof. An Annual Report to Shareholders, containing financial statements for the year ended December 31, 2017,2023, and this Proxy Statement are being made available to all shareholders entitled to vote at the Annual Meeting. This Proxy Statement and the form of proxy were first made available to shareholders on or about March 22, 2018.21, 2024. Unless the context requires otherwise, references to "we," "us," "our,"“we,” “us,” “our,” and "Vericel"“Vericel” refer to Vericel Corporation.

GENERAL INFORMATION ABOUT THE MEETING, SOLICITATION AND VOTING

What am I voting on?

This overview highlights certain information contained elsewhere in this Proxy Statement and does not contain all of the information that you should consider. You should read the entire Proxy Statement carefully before voting. For more information about our business and 2023 performance, please review our Annual Report on Form 10-K for the year ended December 31, 2023, as filed with the Securities and Exchange Commission (“SEC”) on February 29, 2024.

There

About Vericel

Vericel is a leading provider of advanced therapies for the sports medicine and severe burn care markets. Whether we are four proposals scheduledtreating damaged cartilage or severe burns, we provide advanced therapies to repair serious injuries and restore lives. Our highly differentiated portfolio of cell therapy and specialty biologic products combines innovations in biology with medical technologies. We were among the first companies to achieve commercial success in the complex field of cell therapies with treatments that use tissue engineering to regenerate skin and healthy knee cartilage.

Today, we are known for putting a patient’s own cells to work — and working for each of our patients. We deliver our therapies with personalized care and attention. This approach has created many promising possibilities for expanding our portfolio. As we grow, our purpose remains the same: to produce therapies as individual as the people who need them.

We currently market three products in the United States. MACI® (autologous cultured chondrocytes on porcine collagen membrane) is an autologous cellularized scaffold product indicated for the repair of symptomatic, single or multiple full-thickness cartilage defects of the knee with or without bone involvement in adults. Epicel® (cultured epidermal autografts) is a permanent skin replacement for the treatment of patients with deep dermal or full thickness burns greater than or equal to 30% of total body surface area. We also hold an exclusive license for North American rights to NexoBrid® (anacaulase-bcdb), a botanical drug product containing proteolytic enzymes, which is indicated for the removal of eschar in adults with deep partial-thickness and/or full-thickness burns.

Our portfolio is unique in that there are significant barriers to entry for competitive products. For MACI and Epicel, which are regulated as combination biologic/device products by the FDA, there are no established generic biosimilar or 510(k) pathways to enter the market, so future entrants will almost certainly be votedrequired to follow a standard clinical trial pathway, which is challenging and the results of which are often uncertain. We believe there are no similarly situated competitors in either of these markets in the near-term.

We believe that our product portfolio provides an exceptionally solid foundation to deliver sustained strong revenue and profitability growth in the years ahead. We expect to further enhance our profile by reinforcing our position as a premier high-growth sports medicine business as we expand our leadership position in the knee cartilage repair market by maximizing certain MACI growth drivers within the product’s current indication, expanding MACI’s indication to encompass new delivery techniques and treatment targets, and creating a second high-growth franchise in burn care with the launch of NexoBrid and continued growth in the utilization of Epicel.

Our Products: Advanced Therapies for the Sports Medicine and Severe Burn Care Markets

| Our lead product is MACI, an advanced cell therapy product that uses a patient’s own cells to repair damaged cartilage tissue and improve function in the knee. We launched MACI in 2017 for the treatment of cartilage defects in the knee, and MACI is now the leading restorative cartilage repair product in the sports medicine market, and the only FDA-approved product in its class. MACI is produced from a patient’s own cells, which are obtained from a biopsy of healthy cartilage, expanded and placed onto a resorbable porcine collagen membrane that is implanted into the area of the cartilage defect through a minimally-invasive outpatient surgical procedure. There are more than 750,000 knee cartilage repair surgical procedures performed each year in the U.S. Of these, approximately 315,000 patients have cartilage defects that are covered by the current MACI label. Based on defect characteristics, surgeons that have implanted MACI consider approximately 125,000 of these patients clinically appropriate for MACI. Approximately 60,000 of the eligible patients have larger lesions that we believe are likely to secure insurance authorization for MACI. Given the number of cartilage injuries, the knee cartilage repair market represents a significant commercial opportunity for MACI, and we estimate that our current overall MACI target addressable market exceeds $3 billion. |

| MACI represented a major technological advancement that resulted in a less invasive, simpler and faster way for orthopedic surgeons to treat patients suffering from knee cartilage damage. We are now focused on the potential arthroscopic delivery of MACI, which would represent the next major procedural advancement in our strategy of continuing to make MACI an even simpler and less invasive procedure for surgeons and patients. We believe the potential approval of MACI ArthroTM will drive continued strong growth for the product. Surgeons have indicated that an arthroscopic delivery method would not only allow the treatment of MACI patients in a less-invasive manner, but would also more easily permit the treatment of cartilage defects in the knee’s femoral condyle and increase the penetration into MACI’s largest market opportunity. The FDA has accepted our submission seeking to expand the MACI label to include arthroscopic delivery of MACI for the treatment of cartilage defects in the knee and we expect to commercially launch MACI Arthro during the third quarter of 2024. In addition to further procedural advancements, we are also making progress on our strategy to expand MACI’s use to other joints. Specifically, our MACI clinical development program is focused on studying MACI’s use to treat cartilage injuries in the ankle, which represents the largest cartilage repair opportunity outside of the knee, and an additional addressable market of approximately $1 billion. We are on track to initiate a MACI Ankle clinical study beginning in 2025 and, if approved, we believe MACI’s expansion into the ankle will be another longer-term growth driver for the product. |

| Epicel is the only cultured epidermal autograft product approved by the FDA for the treatment of adult and pediatric patients with deep dermal or full-thickness burns greater than or equal to 30% of their total body surface area. Epicel is a permanent skin replacement produced from a patient’s own skin cells, which are obtained from two postage stamp-sized biopsies of healthy skin, expanded to form skin grafts, and placed onto the burn wound site. Epicel is an important and potentially life-saving treatment option for patients with severe burns who may not be candidates for autografts due to the severity and extent of their burns. We estimate that there are approximately 600 surviving patients in the U.S. each year with full-thickness burns greater than 40% of total body surface area that are candidates for treatment with Epicel, representing a potential market opportunity of $300 million per year. |

| In 2023, we commercially launched NexoBrid in the United States, which is an innovative treatment for burn patients and which significantly expands our addressable burn care market. NexoBrid is a botanical drug product containing proteolytic enzymes that is indicated for the removal of eschar in adults with deep partial and/or full-thickness thermal burns. NexoBrid satisfies an unmet need in burn treatment by selectively degrading eschar over the course of four hours while preserving viable tissue. The advantages of removing tissue damaged from burns while preserving viable skin are important and NexoBrid’s clinical results, which underpin its BLA approval from the FDA, are compelling in terms of long-term healing outcomes. NexoBrid’s launch activities are well underway with our first patients treated in the U.S. soon after the product entered the market during the fourth quarter of 2023. We estimate that there are approximately 40,000 hospitalized burn patients in the U.S. each year, the majority of whom will require eschar removal and are candidates for treatment with NexoBrid, representing a potential market opportunity of $300 million per year. NexoBrid is also highly synergistic with our existing Burn Care franchise and the use of Epicel. We believe the addition of NexoBrid meaningfully expands our burn care total addressable market to $600 million and we will be targeting a significantly larger segment of hospitalized burn patients with NexoBrid than with Epicel alone. We believe that the indication for NexoBrid in this larger share of the burn care market will both drive NexoBrid uptake and increase Epicel penetration, thus enabling us to build a second high-growth franchise in the burn care market. |

| 6 |  |

Business Highlights

Growth Strategy Leverages Near-Term & Long-Term Opportunities

|  |  |  |

| Strong Financial | High-Growth Sports | Advancing | Second High-Growth |

| Profile | Medicine Franchise | Pipeline | Franchise in Burn Care |

• Total net revenue growth of 20% to $197.5 million in 2023 • Gross margin expansion in 2023 to 69% • Full-year non-GAAP adjusted EBITDA* growth of 40% to $33.9 million, or 17% of total net revenue • $152.6 million in cash, restricted cash and investments and no debt as of December 31, 2023 | • Market leader in knee cartilage repair • 25% MACI revenue growth in 2023 to $164.8 million • Continued strong growth in MACI surgeons and MACI biopsies | • MACI Arthro human factors study submission accepted for review by the FDA • Commercial launch of MACI Arthro expected during Q3 2024 • MACI Ankle program advancing • NexoBrid’s BLA for pediatric indication accepted for review by the FDA | • NexoBrid launched commercially in Q4 2023 • High surgeon interest in NexoBrid |

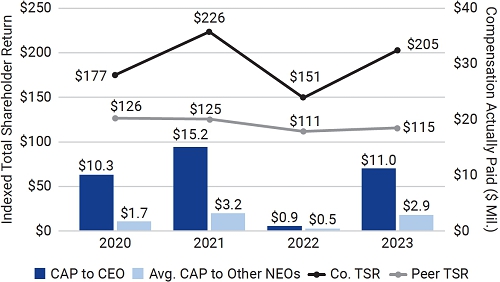

Financial Highlights

Continued Strong Revenue and Profit Growth Across the Organization

| Top-Tier Total Net Revenue Growth | | Year-over-Year Total Net Revenue Growth Adjusted EBITDA* |

| | |

| |  |

• Durable growth platform equating to multiple years of top-tier revenue growth • Significantly underpenetrated markets diversified across two franchises • Strong reimbursement profiles | | • Converting strong revenue growth into cash flow generation • Adjusted-EBITDA* growth of 40% during 2023 • $152.6 million in cash, restricted cash and investments and no debt as of December 31, 2023 • 14 consecutive quarters with positive adjusted EBITDA* and Operating Cash Flow through Q4 2023 |

| * | For more information concerning Vericel’s presentation of non-GAAP measures, including a reconciliation of reported net (loss) income (GAAP) to adjusted EBITDA (non-GAAP), please refer to the Company’s discussion of “GAAP versus non-GAAP Measures”, on page 72 of this Proxy Statement. |

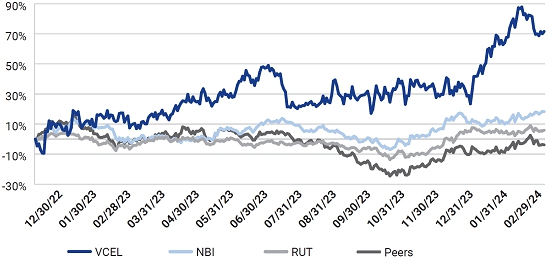

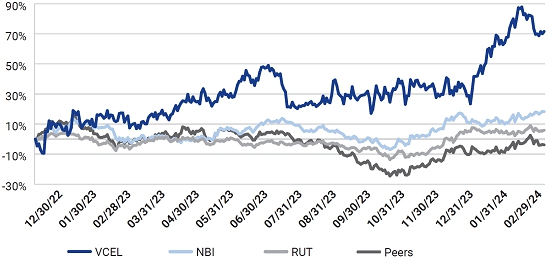

Track Record of Creating Significant Shareholder Value

Trailing Stock Performance

(through March 8, 2024)

We are pleased that our performance and continued execution on our strategic and operational goals have translated into significant value for our shareholders. Between December 30, 2022 and March 8, 2024, the value of Vericel’s publicly-traded stock has increased approximately 72%, outperforming the Nasdaq Biotechnology Index, the Russell 2000 Index and the average of our Proxy Statement Peer Group during that period. For more information concerning our Peer Group companies, see page 48 of this Proxy Statement.

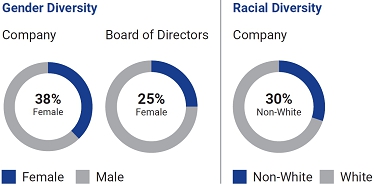

ESG Highlights

We recognize the importance of incorporating Environmental, Social, and Governance (“ESG”) principles into the core of our operations, for our organization and employees, and for the larger communities in which we operate. During 2022, Vericel published its inaugural ESG Report, which highlights for investors our Company’s steadfast commitment to incorporating ESG principles into our everyday business activities. Below is a summary of some of our recent ESG-related activities and achievements.

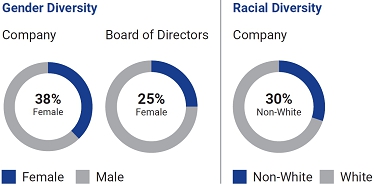

Governance

The Vericel Board of Directors provides oversight of, and strategic guidance to, our executive leadership team on ESG topics. Our Board is comprised of industry leaders with extensive and diverse experiences, which span the business, healthcare, and scientific arenas. The Board continued its focus on developing and implementing the Company’s ESG strategy throughout 2023. The Board has continued to conduct educational programs with outside experts on ESG topics and was involved in the oversight of Vericel’s company-level Diversity and Inclusion Advisory Committee, which is a central component of Vericel’s steadfast commitment to integrating core diversity and inclusion concepts into corporate policies, initiatives, and programs across the organization. See “Oversight of Environmental, Social and Governance Matters” on page 32 of this Proxy Statement for more information on how the Board and its committees exercise ESG oversight.

Environmental

We are committed to minimizing the environmental impact of the Company’s operations and as part of that commitment we have implemented several process improvements and adopted operational efficiencies to reduce our environmental footprint. We have adopted environmentally sustainable practices into our facilities and manufacturing operations and have established procedures and policies to manage our electricity and water usage, as well as the handling of medical and hazardous waste.

The Company is currently constructing a new state-of-the-art advanced cell therapy manufacturing and corporate headquarters facility in the greater Boston area. The 125,000 ft2 facility will significantly increase our cell therapy manufacturing capacity to support the long-term growth of our commercial products. Our manufacturing expansion will enable us to sustain our long-term revenue growth while helping us promote environmentally responsible operations and workforce well-being. We expect to begin occupying our new facility at the

The Company is currently constructing a new state-of-the-art advanced cell therapy manufacturing and corporate headquarters facility in the greater Boston area. The 125,000 ft2 facility will significantly increase our cell therapy manufacturing capacity to support the long-term growth of our commercial products. Our manufacturing expansion will enable us to sustain our long-term revenue growth while helping us promote environmentally responsible operations and workforce well-being. We expect to begin occupying our new facility at the Annual Meeting:end of 2024.

1.To elect seven (7) directorsImportantly, Vericel’s new facility will be located within a campus that is designed and operated in accordance with existing LEED Gold and Fitwel Level 2 certifications. We will continue to evaluate opportunities to manage the Company’s environmental impact as we prepare to transition operations to our new facility.

| 8 |  |

Social

We are passionate, not only about serving the patients and healthcare professionals who use our products, but also about our continuing commitment to our employees.

Patients Access to Our Products | | People Diversity, Equity & Inclusion |

| | |

•More than 17,000 patients have benefited from our innovative advanced cell therapy and specialty biologics products to date. • We are currently developing a custom arthroscopic delivery system for MACI, which we believe could increase MACI’s ease of use for surgeons and reduce both the length of the procedure and the post-operative pain and recovery time for patients. The FDA has accepted our submission seeking to expand the MACI label to include arthroscopic delivery of MACI for the treatment of cartilage defects in the knee and we expect to commercially launch MACI Arthro during the third quarter of 2024. • We are continuing to advance our MACI Ankle indication program which we believe, if approved, could enable patients with cartilage defects in the ankle to be successfully treated with MACI. • We have established a patient support program with dedicated case managers who provide services related to coordination of patient insurance benefits. Product, Quality & Safety • We have established a Quality Management System, which ensures the highest quality standards for our products. •No documented cGMP violations or FDA enforcement actions with respect to any of our operations over the past five years. Compensation and Rewards Program •Pay equity is a core tenet of our compensation philosophy, and internal analyses are conducted regularly to maintain consistency in the administration of these programs. • Components of our compensation and rewards programs include competitive base salary, performance-based bonus targets to incentivize individuals towards the achievement of personal and corporate goals, long-term equity incentive compensation in the form of stock option and RSU grants, and additional employee appreciation programs and events. | | We have an established Diversity and Inclusion Advisory Committee as part of our commitment to diversity, equity and inclusion (“DE&I”). During 2023, we continued to conduct robust DE&I training for both our executive team and employees. As part of that initiative, we implemented an electronic training platform intended to support Vericel in its obligation to train staff on important DE&I programs, as well as policies against harassment and discrimination.

We partner with external experts each year to evaluate our Company demographics and determine areas where we can improve our workforce diversity. We are pleased with the diverse culture we have established at Vericel and with the fact that annual analyses of Vericel’s Affirmative Action Plan (the “Plan”) have not identified any statistically significant deficiencies for the hiring and advancement of women and minorities since the Plan’s inception in 2016. Benefit Programs and Employee Wellness We strive to provide employees with a comprehensive offering of programs to support health and wellness, including: • healthcare; • dental and vision insurance; • flexible spending accounts; • life and accidental death and dismemberment insurance; • employee assistance counseling and education programs; • company contributions to employee 401(k) accounts; • paid time off and leave programs; • tuition assistance; • fitness membership subsidies; and • other programs designed to foster employee health and well-being. We offer our employees internal development and advancement opportunities and encourage continued learning through internal and external programs and educational institutions. |

Corporate Governance

| Board Independence and Composition | | Board Performance Oversight Role | | Policies, Programs and Guidelines |

| | | | |

• 7 out of 8 directors are independent

• 2 out of 8 directors (25%) are women

• 100% independent committee members

•Executive sessions of independent directors at each meeting • Board and committees may engage outside advisers independently of management •Independent Chairman of the Board with clearly delineated duties and robust authority Ethics & Compliance • Establish and maintain a culture of compliance, including a comprehensive Compliance Program consistent with the guidance for pharmaceutical manufacturers published by the U.S. Department of Health and Human Services, Office of Inspector General • Maintain and enforce corporate policies and procedures governing our interactions with healthcare professionals as well as the appropriate promotion of the benefits and risks associated with our products • Robust compliance training and effective monitoring and auditing procedures are performed by members of the Vericel legal and compliance team • Engage with third-party partners to proactively identify and address compliance-related trends as well as state and federal legal and regulatory updates that apply to our business • Comprehensive updates to Vericel’s Code of Business Conduct and Ethics were adopted by the Board in Q4 2023 | | • Oversight of key risk areas and certain aspects of risk management efforts, such as strategic plan development and execution, executive succession planning, cybersecurity, human capital management and the overall management process • Oversight of executive compensation programs to align with long-term strategies Board and Committee Meetings Attendance

Other Board Practices • Annual Board and committee self-evaluations •Board education on key topics, including ESG issues, SEC compliance and cybersecurity Shareholder Rights •Annual election of directors •No shareholder rights plan or “poison pill” | | • Maintain a robust and comprehensive Code of Business Conduct and Ethics • Policy preventing the hedging or pledging of our shares by directors and executive officers • Commitment to diversity of the Board in terms of specific skills and demographics (including expertise, race, ethnicity and gender) • As of December 31, 2023, all officers and directors were in compliance with the requirements of the Company’s Robust Stock Ownership Guidelines • Implementation of comprehensive Corporate Governance Guidelines • Updated Policy for the Recoupment of Erroneously Awarded Incentive Compensation (the “Clawback Policy”) adopted by the Board of Directors in 2023 to comply with the requirements of applicable law and Nasdaq listing rules • Amendment to the Charter of the Governance and Nominating Committee during 2022 to reflect its oversight and management of Vericel’s strategy, initiatives, risks, opportunities, and related reporting with respect to significant ESG topics • Amendment to the Charter of the Compensation Committee during 2023 to reflect its oversight of the Company’s implemented Deferred Compensation Program Information Security & Privacy • Our integrated information technology systems are supported by policies aligned with the National Institute of Standards and Technology Cybersecurity Framework • During 2023, the Company completed a comprehensive effort with outside experts to evaluate and enhance its cybersecurity incident response planning framework |

| 10 |  |

PROPOSAL 1: | | | |

| |

| | | |

Election of Directors |  | The Board recommends a vote FOR each director nominee. |

To elect eight (8) directors, each to serve a term of one year expiring at the 2025 annual meeting of shareholders. | | See page 19  |

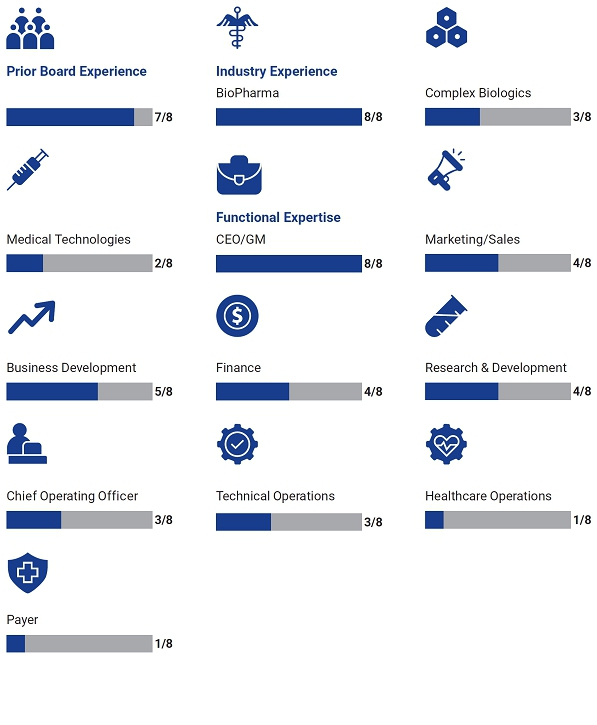

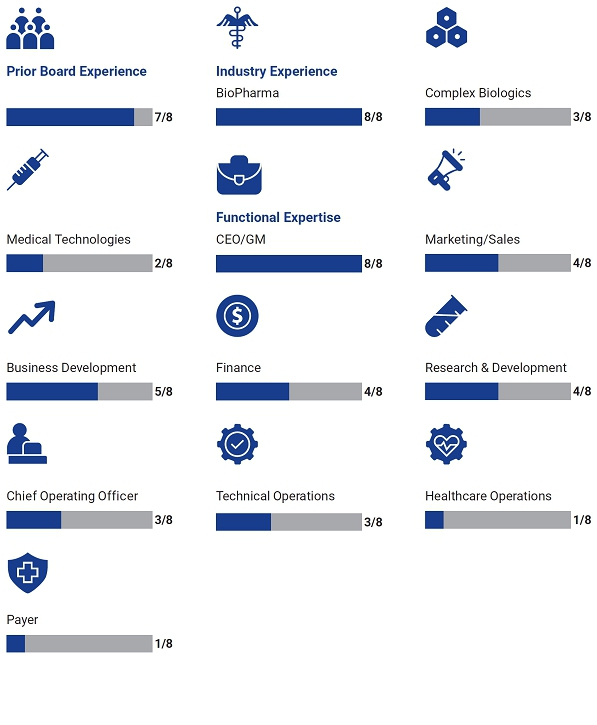

Board Snapshot | | Skills and Experience |

| | |

| |  |

Shareholder Engagement |

| | |

| Vericel greatly values the perspectives that we gain through direct engagement with our shareholders. | | In 2023, our shareholder engagement included participation in multiple investor conferences and numerous individual investor meetings and calls on a variety of topics, such as business and financial performance, Company strategy, executive compensation and product development and commercialization. |

| 12 |  |

PROPOSAL 2: | | | |

| |

| | | |

Advisory Vote to Approve the Compensation of our Named Executive Officers

|  | The Board recommends

a vote FOR this proposal. |

| To vote on an advisory resolution to approve the compensation of Vericel’s named executive officers. | | See page 42 |

|

2023 Financial and Business Performance |

| | | | |

| |  | |  |

$197.5 million Record full-year total net revenue,

representing 20% year-over-year growth | | 40%* Adjusted EBITDA year-over-year

growth rate | | $164.8 million MACI net revenue, representing 25%

year-over-year growth |

| | | | |

| |  | |  |

$33.9 million* Non-GAAP adjusted EBITDA

(Net Loss of $3.2 million) | | $32.7 million Burn Care net revenue; commercial

launch of NexoBrid in Q4 2023 | | $152.6 million Cash, restricted cash and investments

as of December 31, 2023, and no debt |

| * | For more information concerning Vericel’s presentation of non-GAAP measures, including a reconciliation of reported net (loss) income (GAAP) to adjusted EBITDA (non-GAAP), please refer to the Company’s discussion of “GAAP versus non-GAAP Measures”, on page 72 of this Proxy Statement. |

Elements of one year expiring atCompensation

The primary components of our executive officer compensation program are: (i) annual base salary; (ii) annual non-equity incentive compensation, which is based on the 2019 Annual Meetingachievement of Shareholders;

2.- specified Company goals; and (iii) long-term equity incentive compensation in the form of periodic stock options and restricted stock unit (“RSU”) grants, with the objective of aligning the executive officers’ long-term interests with those of our shareholders.

| | Element | | Target Mix | | Strategy and Performance Alignment |

| | Base Salary | |  | | Base salaries are established, in-part, based on the individual experience, skills and expected contributions of our executives, their performance during the prior year, and a comparison against peer group benchmarks. |

| | Annual Non-Equity Incentive Compensation | |  | | The determination of annual incentives for our executives is tied to achieving our financial targets, advancing our commercial and development-stage products and accomplishing operational goals. • Commercial and Financial Performance Goals: 40% • Product Goals: 50% • Operational Goals: 10% Additional Upside Value Goal Opportunity (up to 15%) |

| Long-Term Equity Incentive Compensation | |  | | Long-term incentive compensation aligns employees with shareholders and further incentivizes our executive officers to drive stock price growth and allows them to share in any appreciation in the value of our common stock. |

| |

| 14 |  |

Performance Against Our 2023 Metrics

| Our Goals | | Our Metrics | | Our Performance |

| | Commercial and Financial Performance Goals | | Generate total net product revenues of at least $194.3 million | | • Exceeded total net product revenue goal during 2023 as Company total revenue reached $197.5 million, based largely on MACI’s 25% year-over-year revenue growth |

| Achieve budget expense target of $162.8 million | | • Budget expense target was fractionally below goal in 2023, although the Company’s continued fiscal discipline resulted in the generation of $35.3 million in Operating Cash Flow |

| | Product Goals | | Achieve budgeted MACI surgeon engagement goals of increasing number of biopsy surgeons and MACI biopsy conversion rate; achieve unique Epicel biopsy center target; and secure Pharmacy and Therapeutics (“P&T”) committee approval to purchase NexoBrid at target burn centers | | • MACI biopsy surgeon engagement goal reached at target, while MACI biopsy conversion rate for the year was slightly below the target level; Epicel biopsy centers were achieved at target for the year; and NexoBrid P&T committee approvals were below target as a result of the delay in the commercial launch of the product due to a now-corrected deviation in MediWound’s manufacturing process |

| | Complete MACI, Epicel and NexoBrid long-term brand development initiatives | | • Achieved brand development initiative goals at target, including the continued development of the MACI Ankle program |

| | Complete MACI Arthro human factors study and submit label update to the FDA by December 1, 2023 | | • Exceeded target with respect to the MACI Arthro program as the Company conducted and completed a human factors study during the third quarter of 2023 and submitted a prior approval supplement to the FDA shortly thereafter seeking to add instructions for arthroscopic delivery of MACI to the product’s approved labeling |

| | Operational Goals | | Complete manufacturing facility and key manufacturing/IT efficiency improvement initiatives | | • Exceeded target with respect to manufacturing facility and key manufacturing/IT efficiency improvement goals |

| | Upside Value Goals | | Execute high-quality business development transaction | | • Company strategically chose not to execute any business development transactions during 2023 |

Governance Features of Our Executive Compensation Program

| What We Do | |  | What We Don’t Do |

| | | | | | |

| |  Design executive compensation to align pay with performance Design executive compensation to align pay with performance

Balance short-and long-term incentive compensation to incentivize achievement of short-and long-term goals Balance short-and long-term incentive compensation to incentivize achievement of short-and long-term goals

Retain an independent compensation consultant reporting directly to the Compensation Committee Retain an independent compensation consultant reporting directly to the Compensation Committee

Provide shareholders with an annual say-on-pay vote Provide shareholders with an annual say-on-pay vote

Prohibit short-sales, hedging, pledging or other inherently speculative transactions by our directors and employees (including our executives) (for more information, please see our Special Trading Procedures for Insiders, available at www.vcel.com) Prohibit short-sales, hedging, pledging or other inherently speculative transactions by our directors and employees (including our executives) (for more information, please see our Special Trading Procedures for Insiders, available at www.vcel.com)

Conduct competitive benchmarking of our executive compensation program against the market Conduct competitive benchmarking of our executive compensation program against the market

Maintain robust Stock Ownership Guidelines that apply to our directors and named executive officers Maintain robust Stock Ownership Guidelines that apply to our directors and named executive officers

Maintain a compensation Clawback Policy in accordance with applicable law and Nasdaq listing rules, which covers both cash and equity incentive compensation and requires recoupment of the incentive compensation of our executive officers in situations involving certain accounting restatements of financial results Maintain a compensation Clawback Policy in accordance with applicable law and Nasdaq listing rules, which covers both cash and equity incentive compensation and requires recoupment of the incentive compensation of our executive officers in situations involving certain accounting restatements of financial results

| | | |  No excessive perquisites No excessive perquisites

No tax gross-ups on executive perquisites or on executive severance or change-in-control benefits No tax gross-ups on executive perquisites or on executive severance or change-in-control benefits

No single-trigger change-in-control benefits No single-trigger change-in-control benefits

Do not provide supplemental company-paid retirement benefits Do not provide supplemental company-paid retirement benefits

Our equity plan does not permit “evergreen” replenishment of shares Our equity plan does not permit “evergreen” replenishment of shares

Do not provide dividends or dividend equivalents on unearned equity awards Do not provide dividends or dividend equivalents on unearned equity awards

Do not reprice stock options without prior shareholder approval Do not reprice stock options without prior shareholder approval

|

| |

| 16 |  |

| PROPOSAL 3: | | | |

| | |

Advisory Vote on the Frequency

of Future Advisory Votes to

Approve the Compensation of our

Named Executive Officers |  | The Board recommends a vote that future non-binding, advisory votes to approve the compensation of our named executive officers be held every 1 YEAR |

| To cast an advisory vote on the frequency of future non-binding, advisory votes to approve the compensation of our named executive officers. | | See page 63  |

| PROPOSAL 4: | | | |

| | |

Ratification of Appointment of

Independent Registered Public

Accounting Firm |  | The Board recommends a vote FOR this proposal. |

| To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2024. | | See page 64  |

The Audit Committee has selected PricewaterhouseCoopers LLP (“PwC”) as Vericel’s independent registered public accounting firm to audit the consolidated financial statements of Vericel for the fiscal year ending December 31, 2024. PwC has acted in such capacity since its appointment in fiscal year 1996.

As part of its duties, the Audit Committee considered the provision of services, other than audit services, during the fiscal year ended December 31, 2023 by PwC, our independent registered public accounting firm for that period, to ensure the firm maintains its independence. The following table sets forth the aggregate fees accrued by Vericel for the fiscal year endingyears ended December 31, 2018;

3.To cast an advisory vote on2022 and 2023, respectively, for PwC:| Name | | Fiscal Year Ended

December 31, 2022

($) | | | Fiscal Year Ended

December 31, 2023

($) | |

| Audit Fees | | | 1,261,700 | (1) | | | 1,329,500 | (1) |

| Audit Related Fees | | | — | | | | — | |

| Tax Fees | | | — | | | | — | |

| All Other Fees | | | 2,993 | (2) | | | 3,074 | (2) |

| Total | | | 1,264,693 | | | | 1,332,574 | |

| (1) | The Audit Fees for the years ended December 31, 2022 and 2023 were for professional services rendered for the audits and reviews of the consolidated financial statements of Vericel, professional services rendered for issuance of consents, assistance with review of documents filed with the SEC and out-of-pocket expenses incurred. |

| (2) | All other Fees represent an annual license fee for technical accounting research software and the use of accounting disclosure checklists. |

| 18 |  |

| PROPOSAL 1: | | | |

| | |

Election of Directors |  | The Board recommends a vote FOR the election of each nominee. |

Overview

The Vericel Board of Directors provides oversight of, and strategic guidance to, our Company’s senior management. The core responsibility of a director is to fulfill his or her duties of care and loyalty and otherwise exercise his or her business judgment in the frequency of future advisory votes to approve the compensation of our named executive officers; and

4.To approve, on an advisory basis, the compensation of our named executive officers.

Who is entitled to vote?

Shareholders asbest interests of the close of business on March 9, 2018 (the "Record Date") may vote atCompany and its shareholders. The Board is responsible for overseeing the Annual Meeting. You have one voteCompany’s officers, including the President and Chief Executive Officer, and for each share of common stock you held onensuring that management advances the Record Date, including shares:

•Held directly in your name as "shareholder of record" (also referred to as "registered shareholder"); and

•Held for you in an account with a broker, bank or other nominee (shares held in "street name"). Street name holders generally cannot vote their shares directly and must instead instruct the brokerage firm, bank or nominee how to vote their shares.

What constitutes a quorum?

A majorityinterests of the outstanding shares entitled to vote, present in person or represented by proxy, constitutes a quorum forshareholders through the Annual Meeting. Abstentions are counted as present and entitled to vote for purposes of determining a quorum. "Broker non-votes" (described below) are also counted as

Table of Contents

present and entitled to vote for purposes of determining a quorum. Asoperation of the Record Date, 36,439,270 shares of Vericel's common stock were outstandingCompany’s business. The Board recognizes that it is management’s responsibility to carry out the policies and entitled to vote.

How many votes are required to approve each proposal?

The following explains how many votes are required to approve each proposal, provided that a majority of our shares is present at the Annual Meeting (present in person or represented by proxy).

•The seven (7) candidates for election who receive a plurality vote in the affirmative will be elected;

•Ratifying PricewaterhouseCoopers LLP as Vericel's independent registered public accounting firm for fiscal year ending December 31, 2018 requires the affirmative vote of a majority of the votes cast on the proposal;

•On the non-binding advisory vote on the frequency of future advisory votes to approve the compensation of our named executive officers, the frequency (every one, two or three years) that receives the highest number of votes cast on the proposal shall be deemed the frequency recommended by shareholders; and

•Approval of the non-binding, advisory resolution to approve the compensation of our named executive officers, requires the affirmative vote of a majority of the votes cast on the proposal.

How are votes counted and who are the proxies?

You may either vote "FOR" or "WITHHOLD" authority to vote for each nominee for the Board of Directors. Shares present or represented and not so marked as to withhold authority to vote for a particular nominee will be voted in favor of a particular nominee and will be counted toward such nominee's achievement of a plurality. Shares present at the meeting or represented by proxy where the shareholder properly withholds authority to vote for such nominee in accordance with the proxy instructions and "broker non-votes" will not be counted toward such nominee's achievement of plurality.

You may vote "FOR," "AGAINST" or "ABSTAIN" on the ratification of PricewaterhouseCoopers LLP. If you abstain from voting on the proposal to ratify PricewaterhouseCoopers LLP, it will have no effect on the voting of the proposal. Brokers, bankers and other nominees have discretionary voting power on this routine matter and, accordingly, "broker non-votes" will have no effect on the ratification.

You may vote for "1 YEAR," "2 YEARS" "3 YEARS" or "ABSTAIN" on the non-binding, advisory vote on the frequency of future non-binding, advisory resolutions to approve the compensation of our named executive officers. If you abstain from voting on the frequency of future non-binding, advisory resolutions to approve the compensation of the Company's named executive officers, it will have no effect on the voting of the proposal. If you just sign and submit your proxy card without marking your voting instructions, your shares will be voted for holding non-binding, advisory votes to approve the compensation of the Company's named executive officers every "1 YEAR".

You may vote "FOR," "AGAINST" or "ABSTAIN" on the non-binding, advisory resolution approving the compensation of our named executive officers. If you abstain from voting on the non-binding, advisory resolution approving the compensation of our named executive officers, it will have no effect on the voting of the proposal. If you just sign and submit your proxy card without marking your voting instructions, your shares will be voted "FOR" the resolution approving the compensation of our named executive officers.

Table of Contents

The persons named as attorneys-in-fact in the proxies, Dominick C. Colangelo and Gerard Michel, were selectedstrategies approved by the Board and to manage and carry out the operation of Directorsthe Company’s business. Our Board is committed to legal and areethical conduct in fulfilling its responsibilities and it expects all directors, as well as officers and employees of Vericel. All properly executed proxies submitted in timethe Company, to be counted at the Annual Meeting will be voted by such persons at the Annual Meeting. Whereadhere to Vericel’s Code of Business Conduct and Ethics, a choice has been specifiedcopy of which is available on the proxy with respect to the foregoing matters, the shares represented by the proxy will be voted in accordance with the specifications.Company’s website.

What is a broker non-vote?

If you hold your shares in street name and do not provide voting instructions to your broker, your shares will not be voted on any proposal on which your broker does not have discretionary authority to vote (a "broker non-vote"). Shares held by brokers who do not have discretionary authority to vote on a particular matter and who have not received voting instructions from their customers are counted as present for the purpose of determining whether there is a quorum at the Annual Meeting, but are not counted or deemed to be present or represented for the purpose of determining whether shareholders have approved that matter. Pursuant to applicable rules, brokers will have discretionary authority to vote on the proposal to ratify the appointment of PricewaterhouseCoopers LLP.

How does the Board of Directors recommend that I vote?

Our Board is committed to the continuous improvement of Directors recommends that you vote your shares:

•"FOR" eachour corporate governance structure, the principles of enterprise-wide diversity and inclusion, the oversight of our corporate ESG initiatives and enhancing the composition and effectiveness of the nominees to the Board of Directors;

•"FOR" the ratification of the appointment of PricewaterhouseCoopers LLP as Vericel's independent registered public accounting firm for the fiscal year ending December 31, 2018;

•Every "1 YEAR" on the frequency of future non-binding, advisory votes to approve the compensation of our named executive officers; and

•"FOR" the advisory resolution to approve the compensation of our named executive officers.

How do I vote my shares without attending the meeting?

itself.

If you are a shareholder of record, you may vote by granting a proxy. For shares held in street name, you may vote by submitting voting instructions to your broker or nominee. In any circumstance, you may vote:

•By Internet or Telephone—You may vote by Internet or telephone by following the voting instructions on the proxy card and onwww.proxyvote.com or as directed by your broker or other nominee. In order to vote via the Internet or by telephone, you must have the shareholder identification number which is provided in your Notice.

•By Mail—If you requested a proxy card by mail, you may vote by signing, voting and returning your proxy card in the envelope provided. You should sign your name exactly as it appears on the proxy card. If you are signing in a representative capacity (for example, as guardian, executor, trustee, custodian, attorney or officer of a corporation), you should indicate your name and title or capacity. If you vote by Internet or telephone, please do not mail the proxy card. Your proxy card must be received prior to the Annual Meeting.

| Recent Governance Enhancements • Board adoption of enhanced Compensation Clawback Policy, as discussed further on page 52 (2023) • Oversight of an in-depth initiative to evaluate and enhance the Company’s cybersecurity incident response framework and readiness (2022-2023) •Termination of shareholder rights plan or “poison” pill (2021) • Implementation of comprehensive Corporate Governance Guidelines (2021) • Adoption of formal Stock Ownership Guidelines, with which all directors and officers were in compliance as of December 31, 2023 |

| Board Composition and Effectiveness • Added new director with expertise in healthcare operations and payer matters (2021) • Robust Board self-assessment process in place to continuously evaluate the relevant skills and attributes of the Board’s individual members as well as the effectiveness of the Board as a whole |

| Diversity & Inclusion • Increased gender and racial diversity of Board (2021) • Continued oversight of Vericel Diversity and Inclusion Advisory Committee, which is committed to furthering and strengthening our workforce diversity across all levels of the organization |

| ESG Oversight • Oversaw the creation and publication of Vericel’s inaugural ESG report highlighting our Company’s commitment to incorporating ESG principles into our everyday business activities (2022) • Designated the Governance and Nominating Committee to oversee management of ESG-related matters (2022) |

Internet and telephone voting facilities will close at 11:59 p.m., Eastern Standard Time, on May 1, 2018.

Table of Contents

How do I vote my shares in person at the meeting?

If you are a shareholder of record (also referred to as "registered shareholder") and prefer to vote your shares in person at the meeting, bring proof of identification and request a ballot to vote at the meeting. You may vote shares held in street name only if you obtain a signed proxy from the record holder (broker or other nominee) giving you the right to vote the shares.

Even if you plan to attend the meeting, we encourage you to vote in advance by Internet, telephone or mail so that your vote will be counted even if you are unable to attend the meeting.

What does it mean if I receive more than one proxy card?

It generally means you hold shares registered in more than one account. To ensure that all your shares are voted, vote according to the instructions for each proxy card you receive.

May I change my vote?

Yes. Whether you have voted by Internet, telephone or mail you may change your vote and revoke your proxy by:

•Sending a written statement to that effect to the Corporate Secretary of Vericel;

•Voting by Internet or telephone at a later time;

•Submitting a properly signed proxy card with a later date; or

•Voting in person at the Annual Meeting.

What are the costs associated with the solicitation of proxies?

The cost of soliciting proxies will be borne by us. Voting results will be tabulated and certified by Broadridge Financial Solutions. Vericel may solicit shareholders by mail through its regular employees, and will request banks and brokers, and other custodians, nominees and fiduciaries, to solicit their customers who have our stock registered in the names of such persons and will reimburse them for their reasonable, out-of-pocket costs. Vericel may use the services of its officers, directors, and others to solicit proxies, personally or by telephone, without additional compensation.

Table of Contents

PROPOSAL 1

ELECTION OF DIRECTORS

Our Company’s Amended and Restated Bylaws (“Bylaws”) provide that the Board of Directors will consist of not less than five nor more than nine members, as fixed from time to timetime-to-time by a resolution of the Board, of Directors and that all directors will be elected annually. The Board of Directors currently consists of seveneight (8) directors. The persons named below as nominees for director will, if elected, each serve a term of one year expiring at the 2019 Annual Meeting2025 annual meeting of Shareholders andshareholders or until their successors are elected and qualified.

The table below sets forth Vericel's directors and nominees and their respective ages as of February 28, 2017.

| | | | | | | | | |

| Name | | Position | | Age | | Director Since | |

|---|

Robert L. Zerbe, M.D.* | | Chairman of the Board of Directors | | | 67 | | | 2006 | |

Dominick C. Colangelo* | | President and Chief Executive Officer and Director | | | 54 | | | 2013 | |

Alan L. Rubino* | | Director | | | 63 | | | 2005 | |

Heidi Hagen* | | Director | | | 49 | | | 2013 | |

Steven Gilman, Ph.D.* | | Director | | | 65 | | | 2015 | |

Kevin F. McLaughlin* | | Director | | | 61 | | | 2015 | |

Paul Wotton, Ph.D.* | | Director | | | 57 | | | 2015 | |

Director Nominees for Election at the 2018 Annual Meeting of Shareholders

The biographical description below for each director nominee includes the specific experience, qualifications, attributes and skills that led to the conclusion by the Board of Directors that such person should serve as a director of Vericel.

Robert L. Zerbe, M.D., a Director since January 2006 and Chairman of the Board of Directors since October 2012, was, until July 2016, the Chief Executive Officer of QUATRx Pharmaceuticals Company, a venture-backed drug development company which he co-founded in 2000. Prior to his role at QUATRx, Dr. Zerbe held several senior executive management positions with major pharmaceutical companies including Eli Lilly and Company (from 1982 to 1993) and Pfizer (formerly Parke-Davis) (from 1993 to 2000). During his tenure at Eli Lilly and Company, Dr. Zerbe's clinical research and development positions included Managing Director, Lilly Research Center U.K., and Vice President of Clinical Investigation and Regulatory Affairs. He joined Parke-Davis in 1993, becoming Senior Vice President of Worldwide Clinical Research and Development. In this capacity he led the clinical development programs for a number of key products, including Lipitor® and Neurontin®. Dr. Zerbe received his M.D. from the Indiana University School of Medicine, and has completed post-doctoral work in internal medicine, endocrinology and neuroendocrinology at Indiana University and the National Institutes of Health. He also serves on the Board of Directors of Metabolic Solutions Development Company and Cirius Therapeutics, both private companies focusing on metabolic diseases. The Board of Directors believes Dr. Zerbe's qualifications to sit on our Board of Directors include his management positions at major pharmaceutical companies, including the experience he gleaned in his clinical development roles.

Dominick C. Colangelo, a Director since March 2013, has served as Vericel's President and Chief Executive Officer since March 2013. Mr. Colangelo has more than twenty years of executive management and corporate development experience in the biopharmaceutical industry, including nearly

Table of Contents

a decade with Eli Lilly and Company. During his career, he has held a variety of executive positions of increasing responsibility in product development, pharmaceutical operations, sales and marketing, and corporate development. He has extensive experience in the acquisition, development and commercialization of products across a variety of therapeutic areas. During his tenure at Eli Lilly and Company, he held positions as Director of Strategy and Business Development for Lilly's Diabetes Product Group and also served as a founding Managing Director of Lilly Ventures. Mr. Colangelo received his B.S.B.A. in Accounting, Magna Cum Laude, from the State University of New York at Buffalo and a J.D. degree, with Honors, from the Duke University School of Law. The Board of Directors believes Mr. Colangelo's qualifications to sit on our Board of Directors include his significant contributions within the biopharmaceutical industry.

Alan L. Rubino, a Director since September 2005, has served as Chief Executive Officer and President of Emisphere Technologies, Inc., a publicly-held company headquartered in Roseland, New Jersey since September 2012. Prior to joining Emisphere, Mr. Rubino served as Chief Executive Officer and President of New American Therapeutics, Inc., a specialty pharmaceutical company, from October 2010 to August 2012, where he led the acquisition of penciclovir from Novartis AG. From February 2008 to September 2010, Mr. Rubino served as the Chief Executive Officer and President of Akrimax Pharmaceuticals, LLC, an integrated specialty pharmaceutical company. Prior to this he served as President and Chief Operating Officer of Pharmos Corporation, a biopharmaceutical company. Mr. Rubino has continued to expand upon a highly successful and distinguished career that included Hoffmann-La Roche, Inc., a research-focused healthcare company, from 1977 to 2001, where he was a member of the U.S. Executive and Operating Committees and an executive officer. During his Roche tenure, he held a series of key executive positions in marketing, sales, business operations, supply chain and human resource management. In addition, he was assigned to various executive committee roles in the areas of marketing, project management, and globalization of Roche Holdings. Mr. Rubino also held senior executive positions at PDI, Inc., a sales and marketing support company, and Cardinal Health, a company focused on improving the cost-effectiveness of health care, from 2001 to 2003. He received a Bachelor of Arts degree in economics from Rutgers University with a minor in biology/chemistry and also completed post-graduate educational programs at the University of Lausanne and Harvard Business School. Additionally, he serves on the Board of Advisors of Rutgers University School of Business and the Lerner Center for Pharmaceutical Studies. Mr. Rubino has also served as a member of the Board of Directors of SANUWAVE Health, Inc. since 2014, and since May 2010 of Genisphere, Inc., a private company that provides a nanotechnology platform for targeted drug delivery, a method of delivering medication to a patient that increases the concentration of the medication in targeted parts of the body. The Board of Directors believes Mr. Rubino's qualifications to sit on our Board of Directors include his leadership roles in the life sciences industry in a wide range of positions, including positions focused on sales and marketing and SEC matters.

Heidi Hagen, a Director since August 2013, has been a biotechnology and pharma operations and technology consultant with HH Consulting LLC since October 2012. Since October 2015, Ms. Hagen has served as Chief Strategy Officer for Vineti Inc., a privately-held company that develops and sells cloud-based software platforms for ordering, manufacturing and delivering personalized medicines. Previously, Ms. Hagen served as interim Chief Commercial Officer at ZappRx, Inc. from January 2015 to June 2015. Prior to that, Ms. Hagen served as Global Chief Operating Officer at Sotio LLC, a biotechnology company developing new therapies for the treatment of cancer and autoimmune diseases using its immunotherapy platform and proprietary cell-based technologies, from March 2013 to April 2014. Prior to joining Sotio, Ms. Hagen was Senior Vice President of Operations at Dendreon Corporation, from 2002 to 2012, where she was responsible for, among other duties, manufacturing and supply chain operations. Prior to joining Dendreon, Ms. Hagen spent nearly ten years at Immunex Corporation, where she held several positions in drug development and supply chain and operations management. Ms. Hagen earned her B.S. in cell and molecular biology, M.S. in bioengineering, and

Table of Contents

MBA at the University of Washington. The Board of Directors believes Ms. Hagen's qualifications to sit on our Board of Directors include her leadership roles in the biotechnology industry in a wide range of positions.

Steven C. Gilman, Ph.D., a Director since January 2015, currently serves as the Chairman of the Board of Directors and Chief Executive Officer of ContraFect Corporation. He previously served as the Executive Vice President, Research & Development and Chief Scientific Officer at Cubist Pharmaceuticals from September 2010 until its acquisition by Merck & Co. in January 2015. Prior to joining Cubist, Dr. Gilman served as Chairman of the Board of Directors of and Chief Executive Officer of ActivBiotics, Inc., a privately held biopharmaceutical company, from March 2004 to October 2007. Previously, Dr. Gilman worked at Millennium Pharmaceuticals, Inc., where he held a number of senior leadership roles including Vice President and General Manager, Inflammation. Prior to Millennium, he was Group Director at Pfizer Global Research and Development and has also held scientific, business, and academic appointments at Wyeth Pharmaceuticals, Inc., Cytogen Corporation, Temple Medical School, and Connecticut College. In addition, Dr. Gilman currently serves on the board of directors of Keryx Biopharmaceuticals, Inc., Momenta Pharmaceuticals, ContraFect Corporation and SCYNEXIS, Inc. Dr. Gilman had also served on the board of directors of the Massachusetts Biotechnology Association. Dr. Gilman received his Ph.D. and M.S. degrees in microbiology from Pennsylvania State University, his post-doctoral training at Scripps Clinic and Research Foundation, and received a B.A. in microbiology from Miami University of Ohio. The Board of Directors believes Dr. Gilman's qualifications to sit on our Board of Directors include his leadership roles in the biopharmaceutical industry in a wide range of positions.

Kevin F. McLaughlin, a Director since January 2015, has been the Senior Vice President, Chief Financial Officer and Treasurer at Acceleron Pharma Inc. since 2010. Previously he served as Senior Vice President and Chief Financial Officer of Qteros, Inc., a cellulosic biofuels company from 2009 to 2010. From 2007 through 2009, he served as the Chief Operating Officer and a director of Aptius Education, Inc., a company which offers publishing services, which he co-founded in 2007. From 1996 through 2007, Mr. McLaughlin held several executive positions with PRAECIS Pharmaceuticals, Inc. He joined PRAECIS as their first Chief Financial Officer where he had responsibility for private financings, partnership financings, the company's initial public offering and subsequent stock offering. Later, Mr. McLaughlin became COO, and then President and Chief Executive Officer, and he served as a member of the board of directors. In this capacity he was responsible for negotiating the sale of the company to GlaxoSmithKline. He began his career in senior financial roles at Prime Computer and Computervision Corporation. Mr. McLaughlin is a member of the Board of Directors of Stealth BioTherapeutics Inc., a privately-held biotechnology company. Mr. McLaughlin received a B.S. in business from Northeastern University and an MBA from Babson College. The Board of Directors believes Mr. McLaughlin's qualifications to sit on our Board of Directors include his leadership roles in the biopharmaceutical industry in a wide range of positions.

Paul Wotton,Ph.D., a Director since January 2015, currently serves as the President and Chief Executive Officer of Sigilon Therapeutics, Inc. Prior to that, he served as the Co-Chairman of the Integration Management Office at Astellas Pharma US, Inc. from February 2016 until May 2016. He served as the President and Chief Executive Officer and a member of the board of directors of Ocata Therapeutics, Inc. from July 2014 until its acquisition by Astellas Pharma US Inc. in February 2016. Prior to Ocata Therapeutics, Inc., Dr. Wotton served as President and Chief Executive Officer and a member of the board of directors of Antares Pharma Inc. from October 2008 to June 2014. Prior to joining Antares, Dr. Wotton was the Chief Executive Officer of Topigen Pharmaceuticals and prior to Topigen, he was the Global Head of Business Development of SkyePharma PLC. Earlier in his career he held senior level positions at Eurand International BV, Penwest Pharmaceuticals, Abbott Laboratories and Merck, Sharp and Dohme. Dr. Wotton is Chairman of the Board of Directors of

Table of Contents

Cynata Therapeutics Limited and a member of the board of directors of Veloxis Pharmaceuticals A/S, where he is also Chairman of the Compensation Committee. He is also past Chairman of the Emerging Companies Advisory Board of BIOTEC Canada. In 2014, Dr. Wotton was named Ernst & Young Entrepreneur of the Year for Life Sciences, New Jersey. Dr. Wotton received his Ph.D. in pharmaceutical sciences from the University of Nottingham. The Board of Directors believes Dr. Wotton's qualifications to sit on our Board of Directors include his leadership roles in the life sciences industry in a wide range of positions.

Vote Required and Board of Directors' Recommendation

The affirmative vote of a plurality of the total shares of common stock entitled to vote and be represented in person or by proxy and entitled to vote is required for the election of each of the nominees. It is the intention of the persons named as proxies to vote such proxy FOR the election of all nominees, unless otherwise directed by the shareholder. The Board of Directors knows of no reason why any of the nominees would be unable or unwilling to serve, but if any nominee should for any reason be unable or unwilling to serve, the proxies will be voted for the election of such other person for the office of director as the Board of Directors may recommend in the place of such nominee.

Shares present or represented and not so marked as to withhold authority to vote for a particular nominee will be voted in favor of a particular nominee and will be counted toward such nominee'snominee’s achievement of a plurality. Shares present at the meeting or represented by proxy where the shareholder properly withholds authority to vote for such nominee in accordance with the proxy instructions and "broker non-votes"“broker non-votes” will not be counted toward such nominee'snominee’s achievement of a plurality.

Board Refreshment and Succession Planning

The Board of Directors recommends that shareholders voteFORCompany regularly examines the election of each nominee named in the above table.

Board Meetingsexperience and Committees

During the fiscal year ended December 31, 2017, the Board of Directors held twelve meetings. Each director serving on the Board of Directors in such fiscal year attended at least 85% of such meetings of the Board of Directors and the Committees on which he or she served.

Audit Committee

Under the terms of its current Charter, the Audit Committee's responsibilities include reviewing with Vericel's independent accountants and management the annual financial statements and independent accountants' opinion, reviewing the scope and results of the examination of Vericel's financial statements by the independent accountants, reviewing all professional services performed and related fees by the independent accountants, approving the retention of the independent accountants and periodically reviewing Vericel's accounting policies and internal accounting and financial controls. The Audit Committee may delegate duties or responsibilities to subcommittees or to one member of the Audit Committee. Mr. McLaughlin (Chair), Mr. Rubino and Dr. Zerbe were members of the Audit Committee during the fiscal year ended December 31, 2017. During the fiscal year ended December 31, 2017, the Audit Committee held six meetings. All membersexpertise of our Audit Committee are independent (as independence is defined in Rule 5605(a)(2)Board as a whole to ensure alignment between the Board’s abilities and as required under Rule 5605(c)(2) of the NASDAQ listing standards). Since March 2015, Mr. McLaughlin has been designated as an audit committee financial expert as defined in the rules of the Securitiesour strategic priorities and Exchange Commission (the "SEC"). The Audit Committee acts pursuant to a written charter, a current copy of which is available on the Investor Relations page of our website, www.vcel.com, and by following the Corporate Governance link. For additional information concerning the Audit Committee, see "Report of the Audit Committee of the Board of Directors."

Table of Contents

Compensation Committee